The low receivables turnover ratio indicates that the company in question is inefficient at collecting debt from customers. What does Low Receivable Turnover Indicate? While a conservative credit policy can help limit risk for a business, it can also force clients to seek the products or services from competitors who are ready to extend credit.

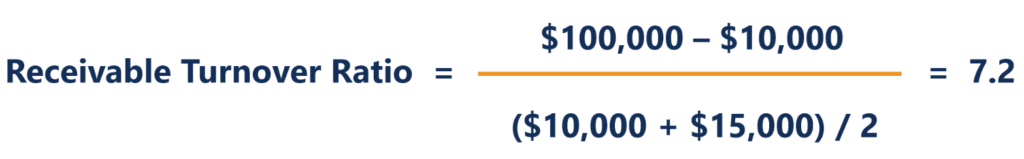

This metric indicates that an average Mehta Group customer repays a credit to the company within 51 days. Therefore, in the case of Mehta Group, the receivable turnover in days is – All they need to do is to divide 365 by the receivables turnover ratio. Thus, Mehta Group collected 7.2 times its accounts receivables throughout 2019.Ĭompanies can acquire accounts receivable turnover in days from this data as well. 20 lakh by the year-end.įrom this information, calculating the receivable turnover ratio for Mehta Group would be simple.Īccounts receivable ratio = (Rs. At the start of this year, the accounts receivable was Rs. 2 crore and returns from customers at that time were Rs. Mehta Group’s gross sales for the year ended December 31st, 2019 was Rs.

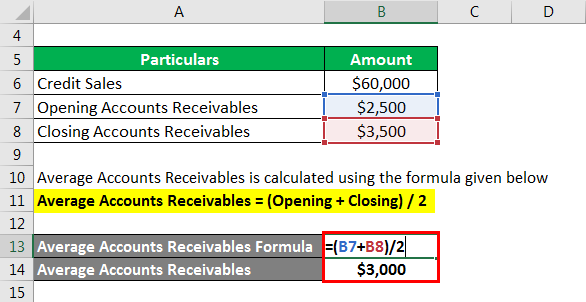

With this receivables turnover formula in mind, consider the following example. Net credit sales = Gross credit sales – customer returns Example of Receivables Turnover Ratio Similarly, net credit sales refer to the revenue generated through sales, which were completed on credit after subtracting the returns from customers. One can acquire the average accounts receivable by adding the accounts receivable at the beginning and the end of the specified period and dividing the result by two.įor instance, if the desired period for receivables turnover ratio is the 2nd quarter in a particular year, one would need to add the actual receivables at the start of this quarter and the end of it, before dividing the sum by 2.

Receivables turnover ratio = Net credit sales/average accounts receivable Thus, the receivables turnover ratio formula is – To find out the receivables turnover ratio for a particular company, two factors are essential – net credit sales and average accounts receivable. Mathematical Formula for Receivables Turnover Ratio The receivables ratio is indicative of how well a company can manage these short-term credits.īesides receivables turnover, this measurement of efficiency is also known as the accounts receivable turnover ratio. The metric used to measure the efficiency at which such debts are extended, and concerned dues are collected is known as the receivables turnover ratio. The management of a company is responsible for collecting such outstanding receivables within a specified time, failing which a business’s cash flow suffers. Businesses often need to extend credit to their clients, whereby the latter receive the inventory without clearing ensuing bills immediately.

0 kommentar(er)

0 kommentar(er)